Debt at these rates with section 8 investing

- Klaus Gmirr

- Oct 6, 2024

- 3 min read

Updated: Jan 28

Like most people, initially I was turned away by the thought of taking on debt at the 7-8% range for 30yr fixed mortgages. After running the numbers and understanding where I wanted to take this small portfolio, I decided to do a cash out refi. When it comes down to it, I’ll be able to pull out almost all the cash I have invested into these deals with some left and still cashflow.

For example, a duplex I bought:

Purchase price was 85,000 after some negotiating, put about 46,000 worth of work into it, re doing the interiors and re doing the plumbing/sewer lines to bullet proof the house instead of just getting continuous repair bills.

For the duplex I was all into it for 131,100. Once the appraisal came back I was shocked, it appraised for 197,000. Indicating I built in over 60,000 in equity in this deal. At a low 65% LTV (Loan to Value, amount of cash you’re able to pull out) I’m able to pull out 128,000. *Note, appraisals do not mean the property can be sold for the appraised price, just a generous estimate of value*

Leaving only a few grand of my own cash in the deal and still cash flowing 4-5k a year off this duplex with covering debt payments, insurance premiums, taxes, property management fee’s and repairs.

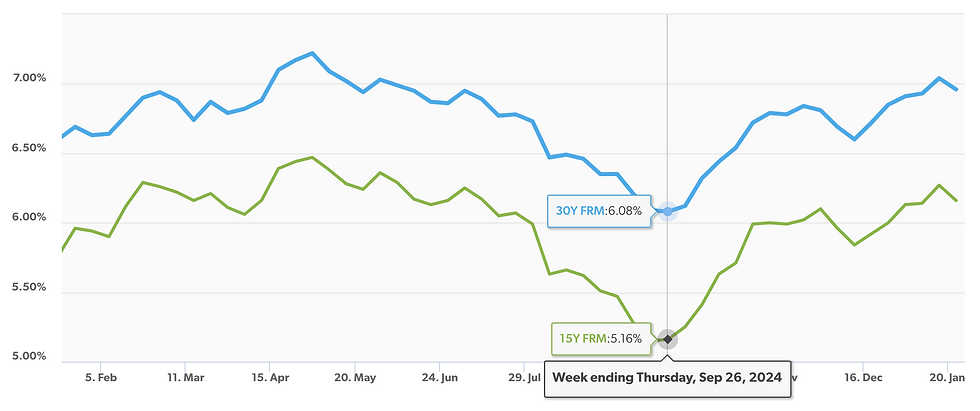

Although it’s not the crazy amount of cashflow, it’ll free up more cash to purchase another similar deal with a large rehab and once the new units leased it’ll bring back up my cashflow until I repeat the cycle. *Note, hopefully soon rates will drop to 3-4% in the next 12-18 months, and with debt that cheap, it makes sense to cash out refi anything as soon as possible*

When thinking about refiing, taxes was a main deciding factor. My believe in real estate is simple, the more debt/leverage, the less taxes. If I’m able to take out cash out of a property that’s debt (Debts non taxable as it’s not income), I’ll be able to swing that into another deal with a large rehab and take 40-60-80% accelerated depreciation of the rehab on the new deal.

So for example based on 60% accelerated depreciation, if I purchase another property for 50,000 with a rehab of 50,000, I’ll be able to take 30,000 worth of depreciation from the rehab just in the first year! and every year for the next 27.5 years I’ll be able to take 1,818 of the sales price of the home at 50,000.

In addition, the other 20,000 worth of rehab depreciation would be taken over a 14 year period typically, so that’s an extra 1,428 in depreciation I’ll be able to take over the next 14 years with this property.

In summary, In the first year of buying a new property off debt, I’ll be taking nearly 32,000 worth of depreciation and the years after 3,200.

At the end of the day, with a sketchy DSCR lender and 12 month pre pay penalty on a 30yr fixed rate mortgage and factoring in the tax savings, the growth opportunities and where I believe rates are heading in the next 12-18 months, I decided to cash out refi with the end goal of refiing the loan again in 12-18 months if rates dip below 4-5%.

Side note, I’m some 21yr old guy who barely has any idea what he’s doing, these thoughts are my beliefs not sure if they’re right or wrong, but sure hope they’re in the right direction with the amount of debt I’ll be taking on.

Update: Sketchy DSCR 30yr fixed rate mortgage secured with 12 month pre pay penalty, at 6.41%.

Note from 1/27/2025: Timing was great. Started the underwriting process for the loan at the beginning of Sep '24 and the loan was funded towards the end of September. Happy with a 6.41% rate as well, typically bundled DSCR mortgages are .5% to 1% higher then traditional mortgages based on income and tax returns not rental property income.

Comentarios